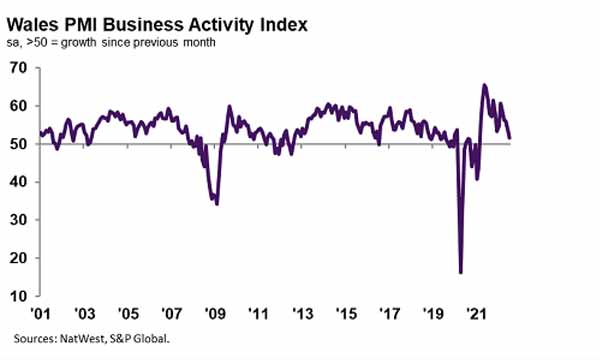

The headline NatWest Wales Enterprise Exercise Index – a seasonally adjusted index that measures the month-on-month change within the mixed output of the area’s manufacturing and repair sectors – registered 51.6 in July, down from 53.6 in June, to sign solely a marginal upturn in output throughout the Welsh personal sector.

The rise in enterprise exercise was the slowest within the present 17-month sequence of progress and barely softer than the UK common. Better output was linked to an additional uptick in shopper demand and new order inflows.

Welsh personal sector corporations registered an additional growth in new enterprise throughout July, with the speed of progress quickening barely from June’s 16-month low. Welsh corporations have been amongst solely three UK areas to report an upturn in new orders, alongside the South East and London. Anecdotal proof said that the rise in new enterprise stemmed from a modest uptick in shopper demand.

The rise in new orders was broad primarily based, with producers and repair suppliers recording a rise.

July information signalled an additional uptick in enterprise confidence at Welsh personal sector corporations. Output expectations for the approaching 12 months have been the strongest for 3 months and better than the collection pattern. Corporations attributed larger optimism to hopes of worth and provide chain stability, alongside elevated shopper demand.

Welsh corporations have been additionally extra optimistic relating to the outlook for output than the UK common.

Welsh personal sector corporations recorded a powerful upturn in employment at the beginning of the third quarter. The speed of job creation was broadly according to that seen in June, however slower than the UK common. Corporations attributed greater workforce numbers to an uptick in shopper demand and larger new order inflows.

Producers and repair suppliers registered a rise in employment, with the latter recording a sharper rise.

The extent of excellent enterprise at Welsh personal sector corporations fell for the third month working in July. The lower in work-in-hand quickened to the quickest since February 2021 and contrasted with the UK common which pointed to broadly unchanged ranges of incomplete enterprise. Comparatively comfortable demand situations and enough capability reportedly allowed corporations to work via their backlogs.

Welsh personal sector corporations indicated a softer tempo of value inflation throughout July. Though the tempo of improve remained traditionally elevated and faster than in any interval earlier than October 2021, it was the slowest since then. Larger enter costs have been linked to larger power, gasoline, materials and wage prices.

The speed of inflation was additionally substantial in relation to different UK areas, slower than solely Northern Eire and the South East.

Common output prices elevated markedly at the beginning of the third quarter, albeit at a softer tempo. The rise in promoting costs was attributed to the pass-through of upper prices to shoppers. That mentioned, according to the pattern for slower will increase in value burdens, corporations recorded the softest rise in output prices since September 2021.

The speed of cost inflation was, nonetheless, among the many quickest of the UK areas, slower than solely Northern Eire, the North East and the South East.

Gemma Casey, NatWest Ecosystem Supervisor for Wales, commented:

“Welsh corporations continued to register output progress throughout July, because the upturn in new enterprise regained tempo. That mentioned, the respective expansions have been subdued within the context of these seen over the previous yr as worth pressures softened demand situations.

“Regardless of indicators of spare capability and a lower in backlogs of labor, firms elevated workforce numbers strongly and recorded a larger diploma of confidence within the yr forward outlook for output. Amid hopes of larger worth stability, corporations reported the slowest rise in enter prices since September 2021. The charges of improve remained traditionally marked, nonetheless, and sooner than any seen earlier than October 2021 as inflationary headwinds endure.”