The price of residing within the UK is dearer than in 80% of nations on this planet with single individual estimated month-to-month prices at £2,201.

In these circumstances, claiming Common Credit score to assist with residing prices is frequent with greater than 5.8 million individuals claiming UC in England, Scotland, and Wales.

We’ll let you know:

- How a lot Common Credit score allowance you will get

- Tricks to lower down your important prices to £250

- Further advantages of Common Credit score you possibly can avail

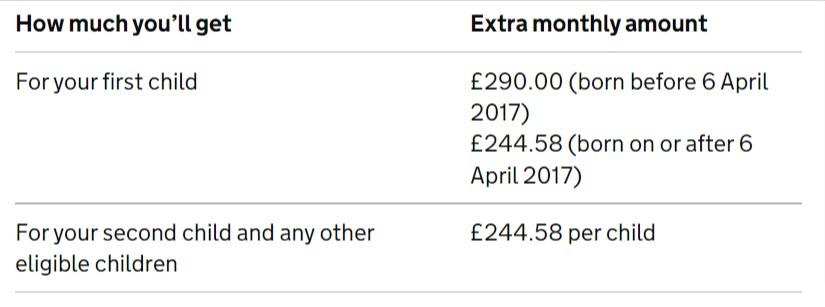

If you’re out of labor or low-income (decrease than UK’s 60% median revenue), you possibly can qualify for the standard allowance:

- The one claimant beneath 25: £265.31 monthly

- Single claimant 25 or over: £334.91 monthly

- Joint claimants each beneath 25: £416.45 monthly

- Joint claimants both aged 25 or over: £525.72 monthly

- Every little one: £250 – £290.

Let’s take a family as an example with two adults and two kids. Common credit score offers you an allowance of round £1000 – £1500. The common disposable revenue within the UK is £31,400. With Common Credit score, you might be nowhere near this quantity. If in case you have a pair exterior Better London, you might have a £20,000 a yr cap, and inside Better London, you might have a £23,000 a yr cap.

The answer is studying to stay on the naked minimal on this time of disaster.

On this article, we are going to assist offer you recommendations on easy methods to cowl your important prices like meals and water for beneath £250 a month. It doesn’t embrace lease which might be anyplace from £800-£1200.

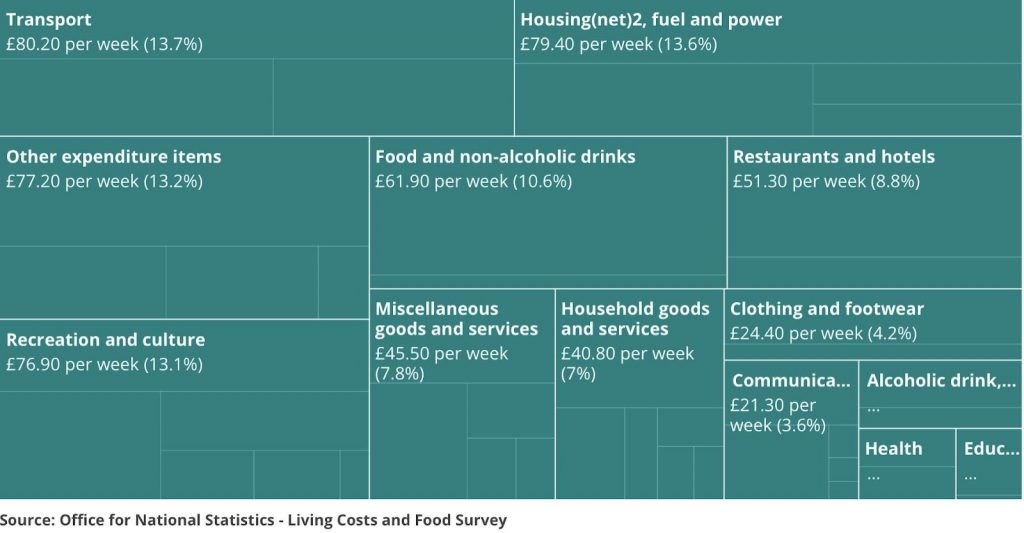

That is how a UK family spends £585.60 per week. Let’s deal with the place we are able to lower down.

1. Reduce down Meals Prices

Households are spending £62/week on meals and 51/week on eating places. Consuming in eating places is just not an possibility in your funds.

Households are spending £62/week on meals and 51/week on eating places. Consuming in eating places is just not an possibility in your funds.

One individual can truly survive on £15-20/week in the case of balanced meals. This involves £60-£80 a month.

Reduce down on restaurant prices by packing your self lunch if you happen to should go to work. You too can do weekly funds meal prep, cook dinner in giant batches, and freeze the leftovers.

Put together extra uncooked meals dishes to save lots of on power for cooking meals.

Tip: View this video to study how one can put together a £6/week meal prep plan. You could find different movies and suggestions from cooks like Jamie Oliver as effectively that can assist you put together low-cost nutritious snacks and meals.

2. Discover low-cost Clothes

One family spends £25/week on clothes. Find good charity outlets like Oxfam Store and native thrift shops round you.

You could find T-shirts for as low-cost as £3. Alternatively, you need to use secondhand outlets or apps the place you should purchase used garments in good situation for sometimes half the worth.

3. Scale back your Family Payments

The main family payments you should pay are electrical energy, warmth, and water, about £80/per week for a mean family.

The main family payments you should pay are electrical energy, warmth, and water, about £80/per week for a mean family.

Worth comparability web sites are your greatest pal. Discover the most affordable sources by evaluating costs.

A four-bed home with an occupancy of 4 individuals can truly handle with £120-150 a month. This implies £30-40/per individual. And if you need to use extra sustainable power sources like photo voltaic, you can also make extra financial savings.

4. Use extra reasonably priced Transport

Abandon your desires of a automotive. There isn’t any set determine of what you possibly can lower your transport prices too as a result of it is dependent upon the place you possibly can commute. A family spends £80/week on commuting. Which suggests one individual spends £80/month.

Abandon your desires of a automotive. There isn’t any set determine of what you possibly can lower your transport prices too as a result of it is dependent upon the place you possibly can commute. A family spends £80/week on commuting. Which suggests one individual spends £80/month.

Right here is how one can get monetary savings on transport:

- Railcards are £30 per yr, and so they may prevent as much as a 3rd of the price of your rail ticket.

- Discover carpool companies on-line.

- Use companies like Trainsplit that cut up the tickets for you.

- Bikes are your greatest pal. Use them for short-distance commutes.

5. Be taught from College students

If we take transport to be £60/month, clothes £40/month, meals £80/month, and payments £40/month, we’re at £190/month.

This offers you room to plan for leisure. There isn’t any doubt that you’ve a social life and have to exit with different individuals even if you find yourself on a funds.

College students have the very best recommendations on saving cash for leisure actions.

- Have more healthy but extra filling meals similar to potato or rice dishes earlier than going out so that you just don’t have to purchase costly takeaway meals later.

- Put together meals for your self earlier than you exit.

- Use apps like Bigdish to seek out low-cost meals and low cost gives.

3 Further Advantages of Common Credit score to be claimed

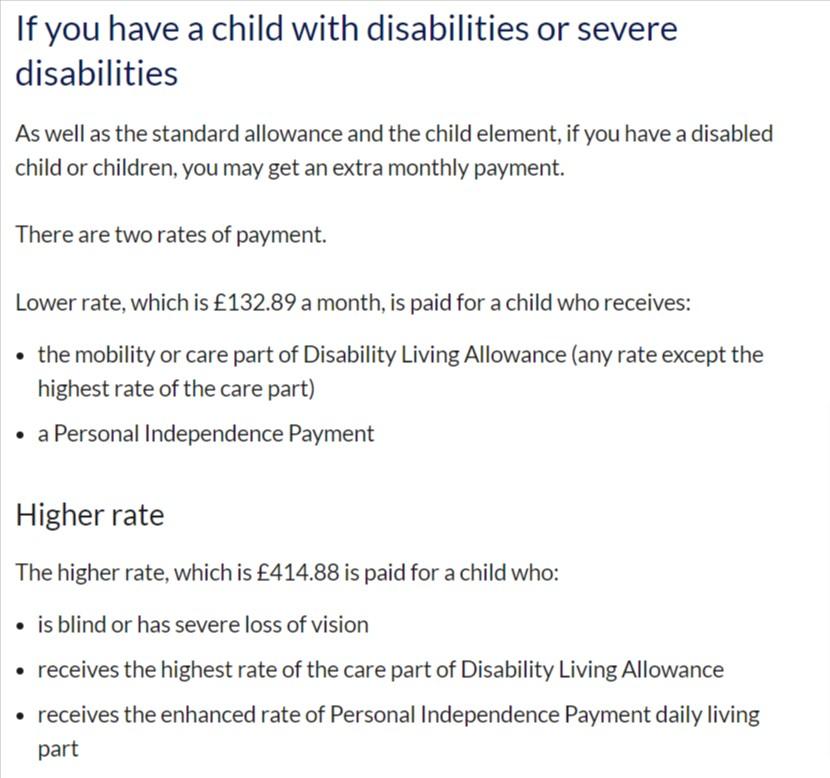

1. Disabled Baby Allowance

Chances are you’ll get more money in case your dependent little one is disabled. This quantity is paid at the next or decrease price based mostly in your circumstances.

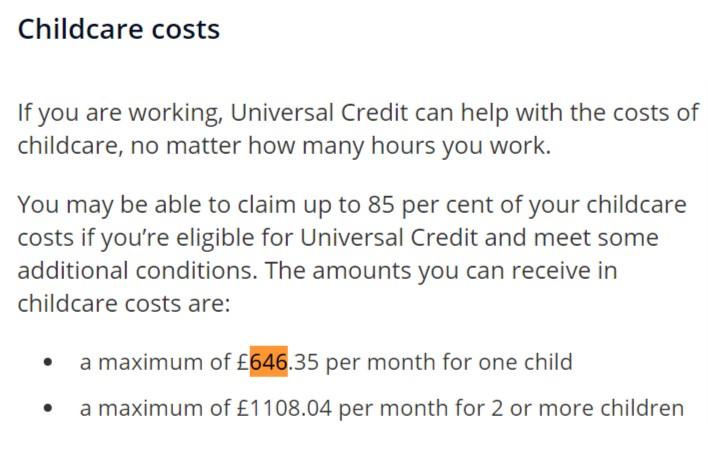

2. Childcare Cowl

Whatever the hours you’re employed, you possibly can apply for Common Credit score to assist with the prices of childcare.

You may declare as much as 85% of your childcare prices if you happen to’re eligible for Common Credit score and meet some extra circumstances. The quantities you possibly can obtain in childcare prices are:

- A most of £646.35 monthly for one little one

- A most of £1108.04 monthly for two or extra kids

3. Additional Assist

You may apply for Common Credit score and get non-monetary perks as effectively.

- Assist with well being prices, together with prescriptions and dental remedy

- Further assist in the direction of housing funds in case your Common Credit score fee is just not sufficient to pay your lease

- Free college meals

- Free early training for two-year-olds

- SureStart maternity grants

- Chilly Climate Funds

- Assist with journey prices to attend job interviews or begin work

- Assist with the supply of clothes to start out work

- Assist with upfront childcare prices till you obtain your first wage

Learn extra concerning the extra advantages that you just would possibly qualify for.

You should utilize these calculators for data on extra advantages:

- Coverage in Follow higher off calculator

- entitledto advantages calculator

- Turn2us advantages calculator

Collect your family details about your financial savings, revenue together with your companion’s (from pay slips, for instance), current advantages and pensions (together with anybody residing with you), outgoings (similar to lease, mortgage, childcare funds), council tax invoice to see how a lot Common Credit score, you possibly can qualify for.

The following tips ought to assist all households which are prone to battle throughout this recession and power disaster and there are a lot of issues households can do to cut back their spending. If in case you have kids which are college students, you possibly can try these profitable pupil finance blogs too for extra inspiration.

Writer Profile

- Shirley Owen is a blogger and author who enjoys writing blogs on training, know-how and common information. An avid reader, she follows all the most recent information & developments to report on them via her articles.

Supply

Supply Supply

Supply Supply

Supply Supply

Supply Supply

Supply Supply

Supply