ACCORDING TO the Cambridge Dictionary, a sanction is ‘a sturdy motion taken in order to make individuals obey a regulation or rule, or a punishment given when they don’t obey’. The aim is fairly apparent, to attempt to deter an motion that’s not deemed by the sanctioner as acceptable.

A baby thus could also be sanctioned for poor behaviour with no sweets for per week. A rustic is equally sanctioned indirectly deemed to hurt the errant nation and never these giving the sanction. Russia has been sanctioned by primarily the US, UK and EU in an unprecedented trend because of the battle in Ukraine. However who’s it hurting?

This text is just not in regards to the morality of the scenario in Ukraine. It’s merely about whether or not the sanctions have been efficient, or have they really been counter-productive? On the most elementary degree, has making use of sanctions made it extra, or much less possible, that UK coverage targets shall be achieved?

A 3rd of a 12 months into battle, the one conclusion one can sanely draw up to now is that the West’s sanctions have been an unmitigated catastrophe in self-harm undermining home prosperity whereas inflicting critical inflationary and financial dislocation.

There may be little or no proof that Western sanctions have materially harmed Russia’s skill to prosecute battle or (as a lot as we are able to decide) diminish Russian home help for it. Removed from Authorities’s expectations that it will cripple the Russian economic system and maybe result in regime change, if something it’s Western economies which are in determined hassle. Plainly US, UK and EU sanctions are proving to be a lose-lose commerce.

A easy check – what foreign money merchants would say

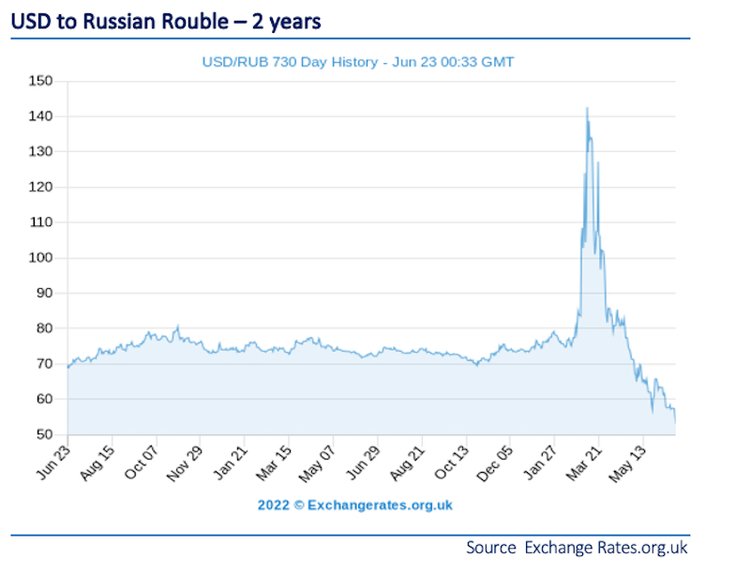

We had been instructed sanctions had been going to cripple the Russian economic system and cease its battle machine. For round two weeks, judging by the foreign money market’s response to a then collapsing rouble, that superficially appeared proper.

Initially the rouble halved from a pre-war 75 to the USD to a low of 140 because the West confiscated over $300billion of Russia’s sovereign property held within the West. This, coupled with a wholesale withdrawal of Western corporations, from BP to McDonald’s, and a tightening of oil and fuel sanctions, resulted in foreign money collapse.

Such a collapse, if extended, would have been very harmful for Russia’s stability because it merely destroys its phrases of commerce, doubtlessly leading to materials inflation as the price of importing items rises considerably.

However Western coverage makers didn’t assume via the second spinoff which is coming again to chew. Economically Russia to an extent is the polar reverse of the West.

The West undoubtedly has vital technological and comfortable energy benefit over Russia. Nonetheless, most Western economies have rising and inefficient public sectors and weak central banking programs impeded by the International Monetary Disaster (GFC) and notably lockdowns, with substantial rising public debt and debased financial programs via a new-found perception in Fashionable Financial Principle (MMT) – accompanied by all of the related Quantitative Easing over the past decade. Britain and the US additionally run substantial commerce deficits.

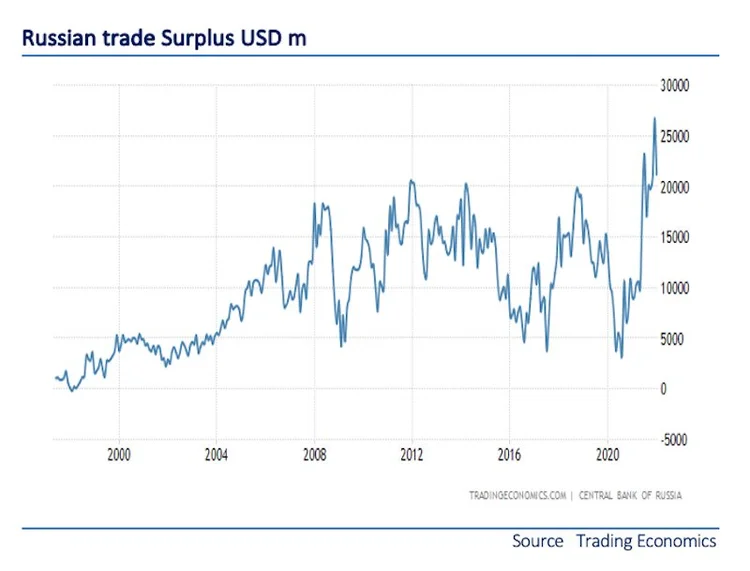

Russia, then again, is a commodity- and first products-led export economic system working a considerable commerce surplus, with weak know-how and repair sector exports and comfortable energy. Its public funds are very sturdy with low public debt, low taxes (14 per cent flat price earnings tax) and substantial money reserves even after half had been sanctioned.

This asymmetry of strategic benefit between Russia and the West has profound implications if sanctions are utilized. Thus fairly shortly foreign money merchants realised what terribly virtually none of our present crop of advantage signalling politicians dare to say – that the sanctions had been doubtlessly extra of a menace to the West (UK and EU specifically) because the affect of ‘cancelling’ Russian carbon was extremely inflationary.

There are not any low cost brief or medium time period substitutes. A lot of the West relies on Russian major merchandise, whereas just some Russians may be upset the Prada retailer in Moscow had closed (however the again door from China remained extensive open). An inconvenience, positive; a sport changer, in all probability not.

Thus the rouble strengthened materially and on the time of writing is 55 to the USD, virtually 30 per cent stronger than earlier than the battle in Ukraine. If one compares the sterling- rouble change price, sterling’s underperformance is even starker.

It’s fairly easy. Cancel Russian oil (13 per cent world manufacturing) and India joyfully buys the discarded inventory at a reduction whereas the worldwide value goes up because the West scrambles to seek out new provide. Worse, cancel Russian fuel and the EU has a significant disaster, as does the UK given the UK’s silly decade-plus de-emphasising of carbon, together with the closure of strategic fuel storage services. The checklist goes on properly past carbon – from titanium to fertiliser, from wheat to cod.

However it’s oil and fuel which are so vital as energy is crucial to the manufacture, to a higher or lesser extent, of most issues. The irony is that in addition to Saudi, Iran and Venezuela, the best beneficiary of hovering hydrocarbon costs is Russia. Putin’s Russia has run constant commerce surpluses however the present surplus is a document, as a direct results of sanctions, taking the spot value of oil from a pre-war $80 a barrel to $120 as we speak.

Whereas the rouble strengthens and the Russian commerce surplus expands, the impact on Western economies has been devastating. In equity the West had been severely undermining its personal benefit for a few years previous to the invasion of Ukraine, fuelled by Governmental insurance policies based mostly on a double fallacy: that financial coverage might remedy all ills, and that centralised decision-making and extreme public spending might remedy all ills.

Each fallacies are actually coming with a considerable value, however to multiply that with an ill-thought-out sanctions regime that’s reaching none of its underlying targets and is harming Western economies is frankly onerous to fathom.

The West, notably the EU and UK, is now in a pickle. This pickle has the potential to be calamitous as Governments stay in denial on the scale of the problem they’re dealing with.

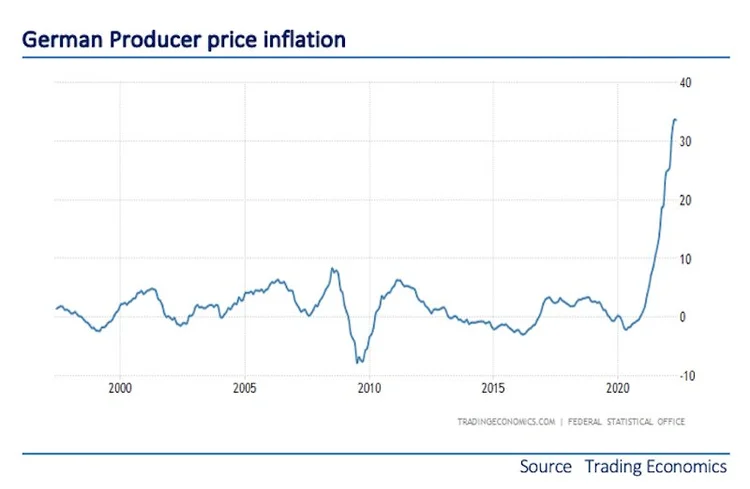

We’re in a scenario the place the inflationary surge, given provide chains, is in its embryo stage, not near its conclusion. Certain, the value rise on the pumps is instant, however home vitality costs are set to extend by an extra 40 per cent in September when the value cap comes off. As a warning, German producer value inflation (see chart beneath) is over 30 per cent, a price not seen since post-war ruination in 1946.

I sincerely hope I’m incorrect however this has the potential to get very nasty. Rishi Sunak mentioned on Wednesday: ‘We’re utilizing all of the instruments at our disposal to deliver inflation down and fight rising costs. We will construct a stronger economic system via impartial financial coverage, accountable fiscal coverage which doesn’t add to inflationary pressures, and by boosting our long-term productiveness and progress.’ That claims to me he hasn’t a clue in regards to the scale of the problem or certainly the underlying causes.

The truth is sadly that each the Financial institution of England and the ECB are up to now behind the curve as to make you weep. Rates of interest of 1.25 per cent when RPI is 11 per cent are up to now off-kilter whereas the ECB, with arguably a good higher inflation headache given German industrial reliance on Russian fuel, is just now coming off unfavorable charges.

Furthermore, increasing a wantonly inefficient public sector to round half your entire economic system coupled with an unprecedented regulatory stranglehold can solely spell a productiveness catastrophe. It’s throwing cash on the dangerous, paid for by the great.

The place it will finish stays unsure, so many unknowns are there. What we are able to predict is that that is the start not the tip of the maelstrom. Governments don’t like short-term ache as elections strategy and we danger yet one more debt-funded stimulus papering over the ever-wider cracks. How credible would that basically be when inflation is 11 per cent? Would they dare print cash once more in such circumstance? I concern they’d.

This nation and certainly Europe typically is enduring monumental self-harm. Sanctions have backfired however the cocktail of sanctions, large public sector growth, delusional financial coverage and delusional vitality coverage danger an financial catastrophe of immense proportion.

There isn’t any straightforward repair however until we want to turn into a northern model of Argentina, with a debased foreign money, fixed disaster and missed alternative, we have to perceive the dimensions and a number of layers of our problem.

It’s too late to keep away from extended and significant inflation, and in time recession, however it’s not too late to begin to rectify coverage error. I can’t see the present crop of politicians analysing forensically the affect of sanctions however an excellent begin could be to toss away the gateway drug to our delusions, the unusual concept that Fashionable Financial Principle works and governments can print and spend their means out of a disaster. Frankly they will’t and with that acceptance maybe we are able to begin the method of an appropriately balanced economic system targeted on non-public exercise, not state path. Authorities received us on this mess, solely the individuals can free us from it.