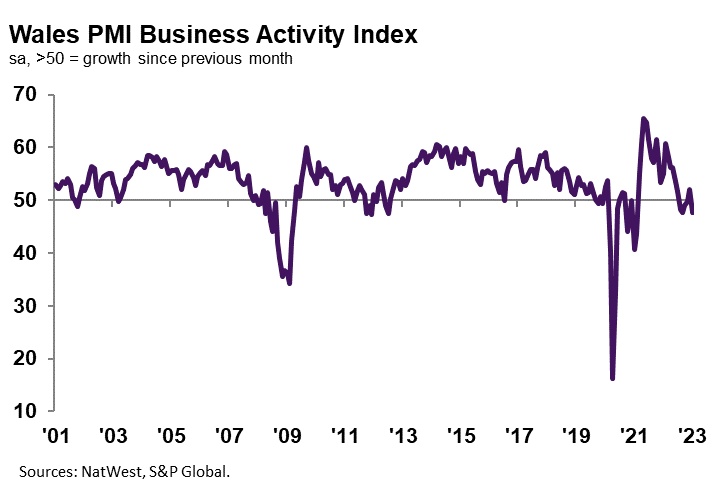

The headline NatWest Wales Enterprise Exercise Index – a seasonally adjusted index that measures the month-on-month change within the mixed output of the area’s manufacturing and repair sectors – registered 47.7 in January, down from 52.0 in December, to sign a renewed fall in enterprise exercise in the beginning of the 12 months.

The modest lower in output was on account of weak demand circumstances and lowered buyer spending following robust inflation, in response to panellists. The downturn in exercise was the quickest since final September and faster than the UK common.

Welsh non-public sector companies registered a renewed fall in new orders within the opening month of 2023. The lower in new enterprise was stable general and the quickest since final October. The downturn was additionally faster than the UK common. Firms famous that decrease new enterprise stemmed from weak demand circumstances in home and exterior markets, as clients lowered spending following extreme inflationary pressures.

Output expectations for the 12 months forward throughout the Welsh non-public sector strengthened throughout January. The diploma of optimism was the very best since July 2022 and above the long-run sequence common. Hopes for higher output have been linked to funding in new product launches and elevated advertising and marketing, alongside aspirations to amass new shoppers.

The extent of optimistic sentiment was solely barely weaker than the UK common.

Welsh non-public sector companies signalled a return to job shedding in January, as firms minimize employment for the primary time since April 2021, albeit marginally. The autumn in workforce numbers was attributed to decrease enterprise necessities following a drop in new orders.

The lower in employment contrasted with unchanged ranges of employees throughout the UK as a complete.

January information signalled a robust decline within the degree of excellent enterprise throughout the Welsh non-public sector. The speed of contraction accelerated to the sharpest since July 2020. The tempo of lower was among the many quickest of the 12 monitored UK areas, with solely Scotland registering a faster fall in work-in-hand.

Welsh companies usually famous that ample capability and a drop in new enterprise drove the autumn in incomplete work.

Common value burdens throughout the Welsh non-public sector elevated at a marked charge once more in the beginning of the 12 months. Hikes in enter costs have been on account of increased wage payments, alongside higher materials, power and utility prices. The speed of value inflation eased to the slowest since April 2021 and was barely weaker than the UK common, regardless of being traditionally elevated.

January information indicated a pointy rise in promoting costs at Welsh non-public sector companies. The speed of cost inflation accelerated for the primary time since October 2022 and was a lot steeper than the long-run common. The rise in output expenses was additionally the quickest of the 12 monitored UK areas. Firms acknowledged that increased promoting costs have been on account of efforts to pass-through rising prices to shoppers.

Gemma Casey, NatWest Ecosystem Supervisor for Wales, commented:

“Welsh companies signalled a return to contraction territory for output and new enterprise in January, as 2023 bought off to a rocky begin. Stress on buyer spending from excessive inflation stymied new gross sales and indicated a turnaround from that seen on the finish of final 12 months. Though value pressures softened once more on the month, companies sought to recoup extra bills by a sharper rise in promoting costs. In reality, output expenses rose on the steepest charge throughout the UK.

“Regardless of enterprise confidence selecting as much as a six-month excessive, Welsh firms have been hesitant of their hiring selections, contributing to a renewed fall in employment. The drop was the primary for 21 months, with lowered new orders reportedly resulting in ample capability to course of incoming work.”