Savills has issued new five-year home worth forecasts for each the prime and mainstream markets. As borrowing prices rise, the housing market will diverge between the mortgage-dependent mainstream markets and the prime markets, broadly the highest 5-10% by worth in every area, the agency says.

After over two years of robust development, the typical UK home worth is anticipated to fall by 10% in 2023 when rates of interest peak, however the prime markets will see smaller falls and outperform over the 5 12 months forecast interval.

There will probably be a rising divergence between money and fairness wealthy or money patrons and different teams of their capability to transact, and between the mainstream market and prime markets the place housing wealth is most concentrated. For instance, prime central London values are anticipated to fall by simply -2% in 2023 and rise by a internet 13.5% by the tip of 2027.

Mainstream market:

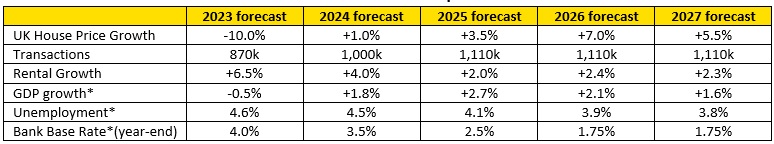

On the belief that rates of interest steadily ease again from the center of 2024, Savills is forecasting that values will start to get better and that the typical UK home worth will rise by a internet determine of +6% in nominal phrases over the following 5 years.

That is anticipated to be accompanied by a fall in housing transactions as first time patrons and buy-to-let buyers bear the brunt of elevated affordability pressures subsequent 12 months, when Financial institution base charge is anticipated to peak at 4.0%.

By finish of the forecast interval (2027), the typical UK home worth is anticipated to be at £381,578, a £22,290 acquire over 5 years. This can put costs a major £92,000 above the pre-pandemic degree, following two and a half years of appreciable development (+24% to the tip of September).

Desk 1: Mainstream market outlook and financial assumptions 2023-2027

Supply: Savills analysis, *Oxford Economics (Word: These forecasts apply to common costs within the second hand market. New construct values might not transfer on the identical charge.)

“The housing market has remained remarkably robust by way of the primary 9 months of 2022, however demand dynamics modified over the autumn with the realisation that the Financial institution of England would want to go sooner and additional to deal with inflation,” says Lucian Cook dinner, Savills head of residential analysis.

“A brand new prime minister and financial coverage U-turns seem to have lowered among the stress on rates of interest, however affordability will nonetheless come beneath actual stress because the impact of upper rates of interest feeds into patrons’ budgets. That, coupled with the numerous value of residing pressures, means we anticipate to see costs fall by as a lot as 10% subsequent 12 months throughout a interval of a lot lowered housing market exercise.

“There are a number of elements that may insulate the market from the chance of a much bigger downturn as seen after the monetary disaster. Debtors who haven’t locked into five-year mounted charges had their affordability closely stress-tested till August this 12 months. This, mixed with comparatively modest unemployment expectations and indicators that lenders need to work with current debtors to assist them handle their family funds, ought to restrict the quantity of forced-sale inventory hitting the market subsequent 12 months.

“And searching long run, the Financial institution of England’s rest of mortgage regulation over the summer season has considerably enhanced the prospect of a worth restoration; however solely as and when rates of interest begin to be lowered, as soon as inflationary pressures within the wider financial system ease.

“In the meantime, rental worth development will proceed to outpace earnings development within the short-term due to the pronounced imbalance between provide and demand, which can come as optimistic information to landlords already going through greater borrowing prices, however will put growing stress on struggling tenants.”

Regional Variation – mainstream

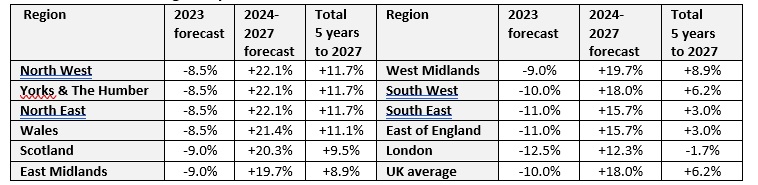

Savills continues to anticipate mainstream housing markets furthest from London, the place mortgage affordability is least stretched, to be the strongest performers over their 5 12 months forecast interval, with barely much less quick time period downward stress on costs and extra capability for worth development in the course of the restoration.

Desk 2: Mainstream regional worth forecasts*

Supply: Savills Analysis (Word: These forecasts apply to common costs within the second hand market. New construct values might not transfer on the identical charge.)

“Historic tendencies counsel that, from a geographical perspective at the very least, we’re simply over midway by way of the second half of a housing market cycle” says Frances McDonald, Savills analysis analyst. “And we anticipate cyclical elements, that are carefully linked to affordability, to proceed to take priority over the regional distribution of financial development over the following 5 years.

“Nonetheless, regional worth development is anticipated to converge across the UK common on the finish of our forecast interval as the worth hole shrinks, probably placing London and the South East again ready to ship the strongest home worth development from 2027 onwards.”

High finish of the market to be most resilient

In the meantime, the prime housing markets (broadly the highest 5%-10% by worth in every area) are anticipated to see smaller worth falls and a stronger restoration than their mainstream counterparts, resulting from much less reliance on mortgage debt. This can cushion them from the affordability issues governing the mainstream markets, however they won’t be utterly proof against greater rates of interest and weaker sentiment feeding upwards from cheaper price bands.

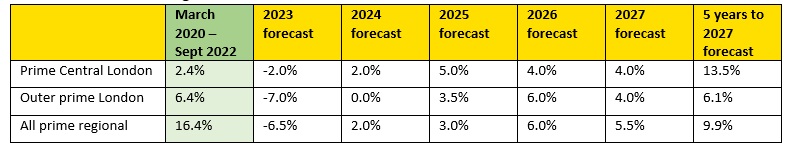

Desk 3: Prime market regional outlook 2023-2027

Supply: Savills Analysis (Word: These forecasts apply to common costs within the second hand market. New construct values might not transfer on the identical charge.)

The distinction between the prime and mainstream markets is anticipated to be most pronounced in prime central London the place costs stay -18% under their 2014 peak, given comparatively modest worth development of simply +2.4% since March 2020.

“The rarefied market in central London’s prime postcodes continues to look good worth in historic phrases, notably when seen within the context of the weaker sterling and robust greenback,” says McDonald.

“A worth restoration on this market seems lengthy overdue. This can assist defend it from extra important worth falls, although it more and more appears to be like like a stronger restoration in costs won’t materialise in earnest earlier than 2025, given the worldwide financial backdrop and prospect of a UK normal election in 2024.”

Prime regional markets, which have recorded unprecedented ranges of worth development for the reason that early days of the pandemic, are anticipated to see falls of 6.5% throughout the course of 2023, however a internet acquire of 10% on common within the 5 years to the tip of 2027.

The broader South, which incorporates the coastal hotspots of Cornwall, Devon and Norfolk, tends to see additional cash patrons and so are prone to be extra resilient. Equally, the worth hole between the Midlands, North and Scotland and wider commuter markets will depart larger capability for development, and so Savills expects them to be the strongest performing areas over the 5 years to 2027.

Daniel Rees, head of residential gross sales for Savills Cardiff, stated:

‘Common home costs throughout Wales have skilled the strongest development since March 2020 of any UK area, with values up by 30.7 per cent to the tip of July this 12 months. This outperformance displays the power of the property market restoration right here. Wanting forward, our researchers predict Wales to see barely much less downward stress on costs subsequent 12 months than the UK common and larger capability for development when inflationary pressures begin to ease. On the prime finish, referred to as the prime market, they’re predicting extra resilience than within the mainstream, particularly inside coastal hotspots.’