With inflation operating rampant and Andrew Bailey, a person so inept he pays full worth for a DFS couch, I believe following his 0.5% improve final month Bailey might be below additional stress to fight the prediction of inflation peaking at 13.3% subsequent 12 months.

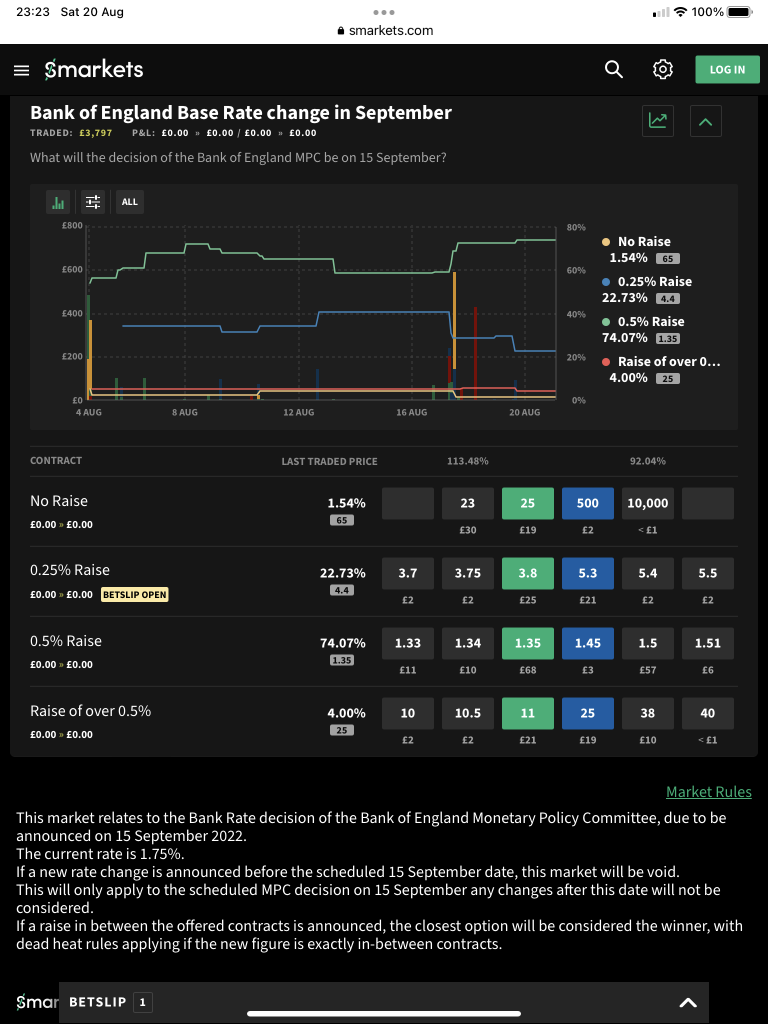

Custom and historical past recommend the optimum strategy to fight the scourge of inflation is to extend rates of interest, with Liz Truss ‘say[ing] she’s going to change the mandate of the BoE to toughen its deal with inflation, whereas she claims that the Treasury‘ so I’m anticipating Bailey to do one thing spectacular to please the incoming Prime Minister which ends up in this betting market from Smarkets.

In my humble opinion Bailey may simply go for a elevate of above 0.5% which after all would additionally go down with the Tory consumer vote who now not have mortgages so the 11s on a elevate of over 0.5% look enticing.

Even a 1% improve would put rates of interest at 2.75% which is by historic requirements may be very low and possibly a damning indictment of the present financial scenario that rates of interest of two.75% might be very dangerous for the financial scenario of many households.

TSE