Two protests in London on Saturday fifteenth January 2011.

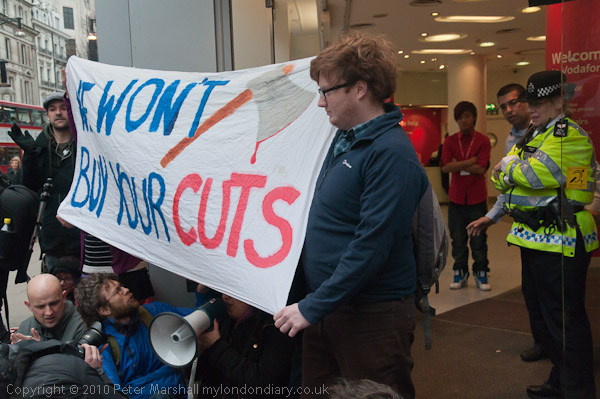

UK Uncut Protest VAT Rise at Vodaphone – Oxford St, 15 Jan 2011

A few days in the past in 2023 the Commons Public Accounts Committee reported that £42bn is excellent in tax debt, with HMRC failing to gather round 5% of tax owing annually. Committee chair Meg Hiller commented “The attention-watering £42bn now owed to HMRC in unpaid taxes would have stuffed a number of this 12 months’s notorious public spending black gap.” The report states that for each £1 the HMRC spends on compliance it recovers £18 in unpaid tax, and the MPs say it merely isn’t attempting laborious sufficient.

As well as, they level to the pathetic effort our tax authorities are making to get better the £4.5 billion misplaced by fraud over Covid assist schemes, solely even “attempting to get better lower than 1 / 4 of estimated losses in schemes comparable to furlough.“

Again in 2011, anti-cuts activists UK Uncut have been campaigning to pressure the federal government to clamp down on tax avoidance moderately than minimize public providers and improve the tax burden on the poor. This protest occurred following an increase in VAT from 17.5% to twenty% and a pair a weeks earlier than the UK deadline for tax returns by the self-employed of January thirty first.

They stated then that wealthy people and corporations comparable to Vodafone, Philip Inexperienced, HSBC, Grolsch, HMV, Boots, Barclays, KPMG and others make use of armies of legal professionals and accountants to use authorized loopholes and dodge round £25 billions in tax whereas the remainder of us on PAYE or extraordinary folks sending in self-assessment tax types pay the complete quantity.

Little has modified since then – besides the quantities concerned may have elevated, however nothing has been performed to maneuver to a fairer strategy to taxation which might remove the authorized dodges and loopholes and demand that tax is paid on cash earned within the UK moderately than being squirrelled away in abroad tax havens. It must be a basic precept that any scheme to intentionally keep away from tax is illegitimate.

Many consider the primary impetus for the Brexit marketing campaign was the intention introduced by Europe to clamp down on tax avoidance, which might have price the rich backers of Vote Go away thousands and thousands by reducing down their dodgy dealings.

UK Uncut held a rally on the pavement on Oxford Avenue exterior Vodaphone, one of many corporations that handle to pay little or no UK tax. Giant numbers of consumers walked by, some stopping briefly to pay attention and applauding the protest.

Audio system identified the regressive nature of VAT, making use of to all purchases of products (besides these exempt from VAT) by everybody no matter their incomes. Earnings tax must be fairer, as it’s associated to revenue and the power to pay – and it will be fairer if the loopholes permitting tax avoidance have been closed.

One speaker made the purpose that multinational corporations not solely use difficult accounting to keep away from UK tax but in addition by shifting earnings to tax havens they deny desperately wanted funds to the poorer nations of the world.

Others spoke concerning the results of the federal government cuts on training, with rising college charges and the elimination of the upkeep allowance that had enabled many poorer college students to stay in sixth-forms. At one level folks held up books as a reminder of the cuts in library providers being compelled on native authorities by the federal government.

A member of the PCS spoke of his concern that the federal government was truly reducing down on the workers who fight tax evasion in addition to enjoyable the principles on tax avoidance moderately than attempting to gather extra from the wealthy.

Prime Minister David Cameron had known as for a ‘Massive Society’ with charities and group organisations taking part in a bigger function – presumably to exchange the general public providers which have been disappearing below his austerity programme. However many of those organisations have been additionally below strain as hard-pressed native authorities have been having to slash funding grants.

Extra at UK Uncut Protest VAT Rise at Vodaphone.

Pillow Struggle Towards Solum at Walthamstow, 15 Jan 2011

Ealier I had photographed Walthamstow residents staging a pillow struggle in protest in opposition to plans for inappropriate excessive rise growth on Walthamstow Central Station automotive park which have been tocome to the council planning committee assembly the next Thursday.

Solum Regeneration had plans to construct a 14 storey lodge and eight storey blocks of flats there, towering over the encompassing space of largely late-Victorian low rise growth.

The scheme had been condemned the earlier 12 months by CABE, the Fee for Structure and the Constructed Atmosphere arrange in 1999 to offer neutral recommendation to the federal government “on structure, city design and public area“, and the builders had made minor modifications which made it even much less acceptable to the native objectors.

Solum Regeneration was arrange by Community Rail and Kier Property to redevelop land round railway stations, together with Walthamstow Central. One in all their different plans was for an enormous redevelopment at Twickenham station, now accomplished after some years of appreciable inconvenience to station customers. Richmond Council had initially turned down this scheme.

Regardless of the pillow struggle and the opposite actions of native campaigners, the Walthamstow scheme additionally bought the go-ahead, with constructing work starting in 2012. Different excessive rise schemes have additionally been authorised within the surrounding space, the character of which has modified significantly.

Pillow Struggle Towards Solum Walthamstow

Tags: Barclays, Boots, Covid fraud, cuts, EMA, flats, Grolsch, havens, excessive rise growth, HMRC, HMV, lodge, HSBC, Kier Property, KPMG, authorized loopholes, library closures, London, NCAFC, Community Rail, peter Marshall, Philip Inexperienced, pillow struggle, protest, Public Accounts Committee, public service cuts, regressive tax, Solum, station automotive park, scholar frees, tax avoidance, tax burden, tax debt, tax loopholes, UK Incut, VAT, VAT rise, Vodafone, Vodaphone

You’ll be able to depart a response, or trackback from your personal website.